“Celery is flirting with $100 per box!” I was recently told this by a prominent buyer in the fresh food industry. This is insane, as during this time last year the price was hovering around $5-$8/case. What’s going on?

The pricing of fresh food is a complicated equation where the trade price is constantly being nudged in a variety of directions by forces that include availability, demand, seasonality and quality. Smart buyers and sellers in the industry seem to navigate this labyrinth with ease. Or do they? How do they reach a price, that sweet spot in a negotiation where a buyer and seller meet and agree to exchange assets?

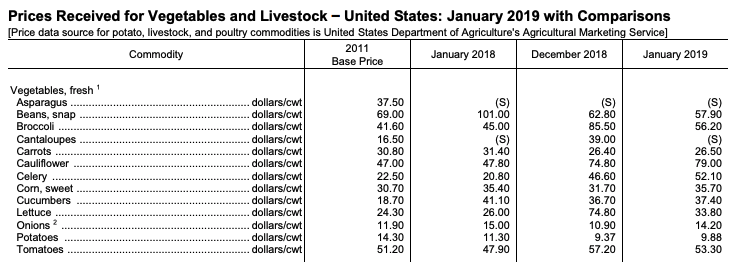

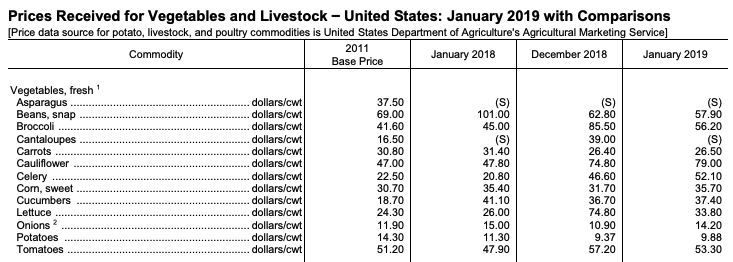

Agricultural Prices Released February 28, 2019, by the National Agricultural Statistics Service (NASS), Agricultural Statistics Board, United States Department of Agriculture (USDA).

Agricultural Prices Released February 28, 2019, by the National Agricultural Statistics Service (NASS), Agricultural Statistics Board, United States Department of Agriculture (USDA).

Seasoned pros in our industry have been performing this daily dance for years, making commitments and taking chances. I’ve heard people say it won’t be until tomorrow that they’ll understand what yesterday’s price should have been. Great, so how do you plan and set pricing in this kind of volatile market?

While there are no perfect answers, I believe it helps to start by looking at the root causes for price fluctuations.

Seasonality

Consumers today are spoiled. Peaches in January? Come on, really? Yes, really. It’s a common practice to have summer fruit all year round. But while demand may be strong, supply issues can arise with global markets and the synchronization of hemispheric markets. Tariffs, market access and the cost of freight all contribute to variability in core pricing that can’t always be passed on to the consumer.

Weather

Most fresh produce is grown outdoors. Mother nature can be cruel, or wonderful, depending on the what side of her randomness you’re on. Gaps in planting create gaps in harvest. Gaps in harvest create gaps in supply. Gaps in supply create upward price pressure. Plus, increases in ambient temperatures often create gluts in supply or spur disease growth. Decreases in temperature often slow everything down, pushing out harvest dates from the initial prediction. All of this makes for bumps along the supply chain.

Improper Planning

In a truly free market everyone acts alone. Annual plans are laid out and adjustments are made along the way by both buyers and sellers. But suppliers and buyers can get out of sync pretty fast. Continuous market imbalances will often find a way into next year’s plan. Some crops simply won’t get planted, or the trees/vines will be pushed out, making the way for newer varieties and upgraded cropping plans.

Demand Spikes

When I asked around about this crazy celery market one explanation I received was that there is a new diet being promoted through social media.

[embed]http://www.youtube.com/watch?v=6mTRitFttN4[/embed]

Celery seems to be the new superfood and it is a hot topic in the juicing culture. Yes, celery is healthy, but when a multitude of juicers get on the bandwagon and promote the benefits of celery on social media it creates a spike in demand while supply stays constant. Economic theory says price must go up.

What a gamble! There is no shortcut either. It’s often said that nine women cannot have a baby in one month, and so it is with growing crops where the planting of a tree or a vine is a commitment that is often is measured in decades. Row crop suppliers of fresh produce can theoretically adjust their plans every month, but I still don’t know anyone with an accurate crystal ball.

So, what can be done? There are a few ways to mitigate the uncertainty and to strategically hedge the downside and take the wins on the upside.

Diversification

A friend of mine, a complex row crop grower, recently explained his diversification plan to me:

“It’s like I manage a mutual fund or a portfolio of stock. First, I divide my season into 52 week-long segments. Then I allocate a percentage of my target crops, at least mathematically, for a predictable harvest quantity each week. Then, working backward from there, I figure out my planting schedule and plan my resource needs. Doing it this way allows me to play a set of statistical set of odds, and sometimes they even work in my favor, at least some of the time.”

In other words, each planting will require 100 days (on average) of his land asset base, plus resources such as fuel and crop treatments. This means that every time he plants he is placing a bet for a potential payout 100 days from now. He knows that historically, based on his internal data and his gut feeling, that he’ll likely be ok. Or at least, in his words, “I’ll hit a strong market in at least one year out of five which will cover the losses I’ve accrued for the other four.”

Do not put all your eggs in one basket. Spread out the risk. Understand the odds of your market. This means menu diversification, inventory diversification and supplier diversification and regional diversification.

Contract Pricing

For buyers and sellers, this can be a way to trim off the volatility of a truly open market. And while this will do nothing if supply is lacking or quality is bad, it can take one variable out of the equation.

Dynamic Ad Placement

Ad promotions are typically planned in advance, but what if seasonal fluctuations could be taken into account? For example, if there is a glut of product on the market, could there be spot promotions to move more in a short period of time? This would help to cover the sunk costs of crop production and remove some of the sting of unforeseen oversupply situations.

Long-term Forecasts

What is the meteorologist saying? What future event might make you think about pushing harvests early or locking up future pricing? There are interesting new applications on the market [LINK] www.weathermelon.com such as WeatherMelon that can quantify and provide alerts on future weather events as they relate to certain crops and regions. Technology can make a difference.

Proper Use of Data

Today’s world seems to be drowning in data, but as one of our prior blog posts points out, there is a lack of information. Are we analyzing the data properly so that we can make quality decisions? Do your information systems, such as your ERP, allow for dynamic data access? The questions may change day to day and any large data repository must work at the speed of thought. Waiting for custom reports and complex data extraction processes is simply not acceptable with today’s modern technology and information systems.

So, what exactly is happening in the celery market? For producers, the historically high price is a nice reprieve and an opportunity to average out the lean seasons. For retailers, the tight supply is a reminder to never put your supply chain analytics on autopilot, and to constantly work to stay ahead of market conditions. And for consumers? Well, there is a surging celery juicing fad that started back in November of 2018 and continues to grow. Everyone, it seems, is feeling the squeeze of a healthy market.

PS - To read more about the recent celery market price surge, check out this article from The Packer.

Procurant USA LLC

180 Westridge Drive - Suite 100

Watsonville, CA 95076

1-669-221-1026

info@procurant.com

Procurant is transforming the global food supply chain with technology to reduce waste, increase visibility, improve food safety and digitize business from production to consumption. The company was founded by industry veterans with decades of experience delivering solutions to growers, shippers, distributors, retailers and foodservice operators.